Introduction & Background

Global power sectors are undergoing a profound transformation with growing shares of variable renewable energy (VRE) resources. To fully utilize these resources while maintaining reliability, reforms are being implemented to enhance the governance and operation of the power sector. Among these reforms, a common theme emerges: wide-area economic dispatch to take advantage of geographic resource diversity, supported by correspondingly broad short-term spot markets. These integrated regional markets have the potential to improve reliability, foster the integration of VRE, and reduce system costs.

In China, electricity market reforms are accelerating. Since 2015, the share of electricity sold through market-based mechanisms has increased from a few percent to over 60 percent today. The majority of these markets take the form of physical medium-to-long (MLT) contracts, which are typically signed months or a year in advance and create binding constraints on grid operators to fulfill. Inter-provincial electricity trade and dispatch, traditionally negotiated between governments, is increasingly embracing market-based approaches—though, in either case, the physical nature of these agreements can increase costs and reduce VRE integration.

Spot markets, which can help solve these integration issues, have been under development in several provinces. Meanwhile, broader regional and national spot markets are in the very early stages. The Southern Grid region is implementing what is intended to be the first regional electricity spot market and the larger State Grid region has a low-volume “inter-provincial spot market” based on market rules issued in 2021.

The primary objective of this paper is to assess the adverse impact of the rigidity associated with physical MLT contracts—specifically within the North China Grid (NCG) and Northeast Grid (NEG) regions—on costs, energy reliability, and VRE integration. We measure renewable integration by curtailment—the amount of “wasted” clean energy that the grid is unable to absorb. Employing a novel approach that utilizes historical inter-provincial flow data as the basis for simulation, we track the influence of physical contracts on key system outcomes and compare with alternative designs governed by more flexible spot markets.

Data & Methodology

We use a unit commitment and economic dispatch model to assess the impact of physical MLT contracts on the electricity sector. The model simulates the production and operation of the electricity sector in the NCG and NEG regions for the entire 2019 year, including generation unit scheduling, dispatch, and transmission flow variables. Inputs include hourly electricity demand, unit-level thermal generation capacity, inter-provincial network capacities, and simulated hourly renewable energy profiles.

This study devises a novel approach to simulate the inter-provincial flow of electricity conducted through physical contracts through entirely open and available resources. First, the annual cumulative inter-provincial transmission flow between each province within the NEG and the NCG is triangulated from multiple statistical sources and grid reports for the year 2019. Second, annual flow data are decomposed to hourly resolution according to time-of-use rate segmentations and simulated hourly electricity consumption data. These hourly inter-provincial flows become binding constraints that simulate MLT inter-provincial flows.

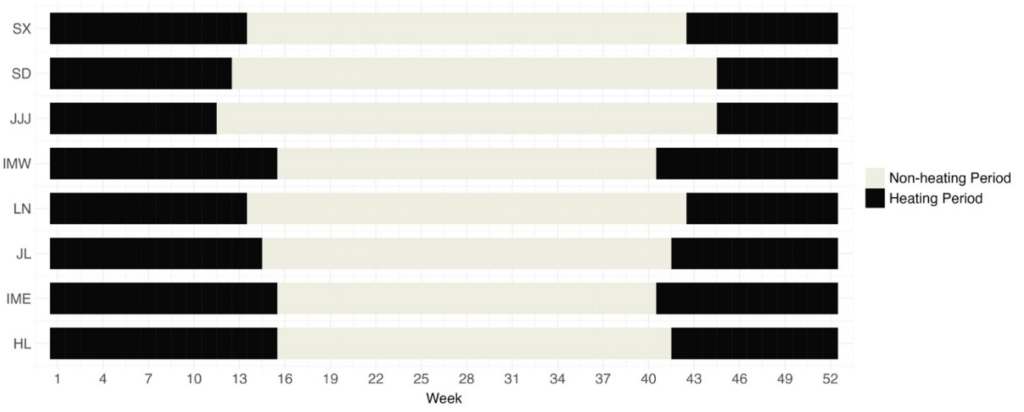

In northern China, a large number of coal power plants are combined heat and power (CHP) units responsible for a significant share of heat supply and are required to operate in winter with little flexibility. The model respects must-run constraints associated with the use of CHP for district heating, using differentiated heating and non-heating periods in each province. For a more detailed discussion on data and methodology, see the Appendix.

Scenario Description & Results

Scenario Description

We analyze deviations from economic dispatch that system operators make to satisfy inter-provincial MLT and inter-regional (between NCG and NEG regions) physical MLT contracts. We compare three simulated scenarios in terms of curtailment, system cost and nonserved energy (NSE; amount of demand not met due to insufficient capacity). The scenarios feature different approaches to dispatch at the regional and inter-regional levels. Intra-provincial dispatch is assumed to be economic in all scenarios. The three scenarios from least to most flexible:

1. Constrained inter-provincial and inter-regional dispatch (MLT Only): All within-region inter-provincial dispatch and inter-regional dispatch is constrained to satisfy physical MLT contracts. This scenario resembles the traditional approach to inter-provincial and inter-regional dispatch.

2. Economic within-region dispatch but constrained inter-regional dispatch (Spot MLT): Inter-provincial dispatch is economic, but inter-regional dispatch is constrained to satisfy physical MLT contracts. This arrangement could be accomplished by establishing regional spot markets within both NCG and NEG.

3. Both regions are dispatched together economically (Spot Only): This scenario involves conducting dispatch (intra-provincial, inter-provincial, and inter-regional) through economic dispatch and could be accomplished through a unified NCG-NEG spot market.

| Intra-provincial dispatch | Intra-regional dispatch | Inter-regional dispatch | |

|---|---|---|---|

| MLT Only | Economic | Constrained | Constrained |

| Spot MLT | Economic | Economic | Constrained |

| Spot Only | Economic | Economic | Economic |

Results

1. Dispatch according to physical MLT contracts results in significant curtailment of variable renewable energy (VRE).

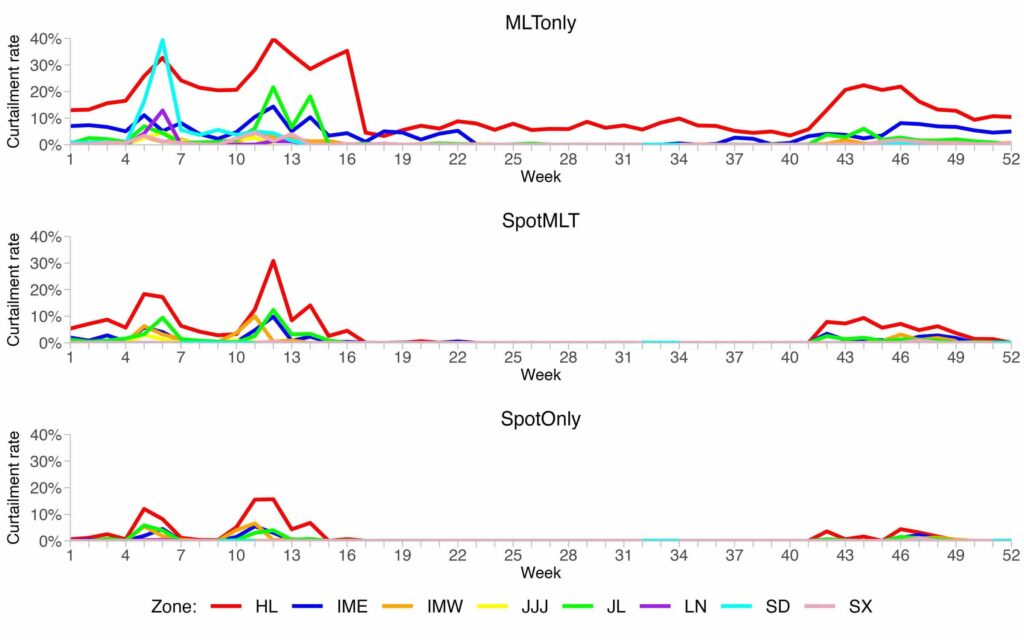

When inter-provincial and inter-regional dispatch is constrained by physical MLT contracts (in the MLT Only scenario), curtailment of VRE increases. Under this scenario, curtailment can reach 40% in Shandong and Heilongjiang during the winter season. Expanding the scope of economic dispatch reduces curtailment substantially (Spot MLT and Spot Only scenarios), with the largest improvements coming from reforming intraregional dispatch.

Uneconomic curtailment modeled here derives from constraints on dispatch to satisfy physical MLT contracts. Grid operators are unable to take advantage of VRE when it is available, and instead a significant portion of inter-provincial and inter-regional electricity transfers are determined months ahead of time. In addition, the MLT Only scenario has the highest variable cost and the highest start cost, indicating higher output of coal-fired generation and more frequent unit start-ups and shut-downs.

2. Introducing regional spot markets enhances the utilization of all resources.

Compared to the MLT Only scenario, both the Spot MLT and Spot Only scenarios demonstrate a substantial surge in exports from Inner Mongolia West to other provinces like Shandong and Shanxi. These represent more efficient flows than historical dispatch, as Inner Mongolia has lower-cost coal units and abundant wind and solar generation.

Modeling outcomes indicate that the establishment of a regional or cross-regional spot market could save 3.5 billion RMB ($500 million) in annual operating costs, equivalent to roughly 10% of overall system costs. The savings are achieved mostly through lower start-up costs and more cost-efficient dispatch. Under no obligations to deliver electricity via physical contracts and relaxed transmission constraints, power plants are operated more efficiently: relatively efficient coal units operate for longer periods with fewer costly start up and shut down cycles, and freely available renewable energy is utilized to a greater extent.

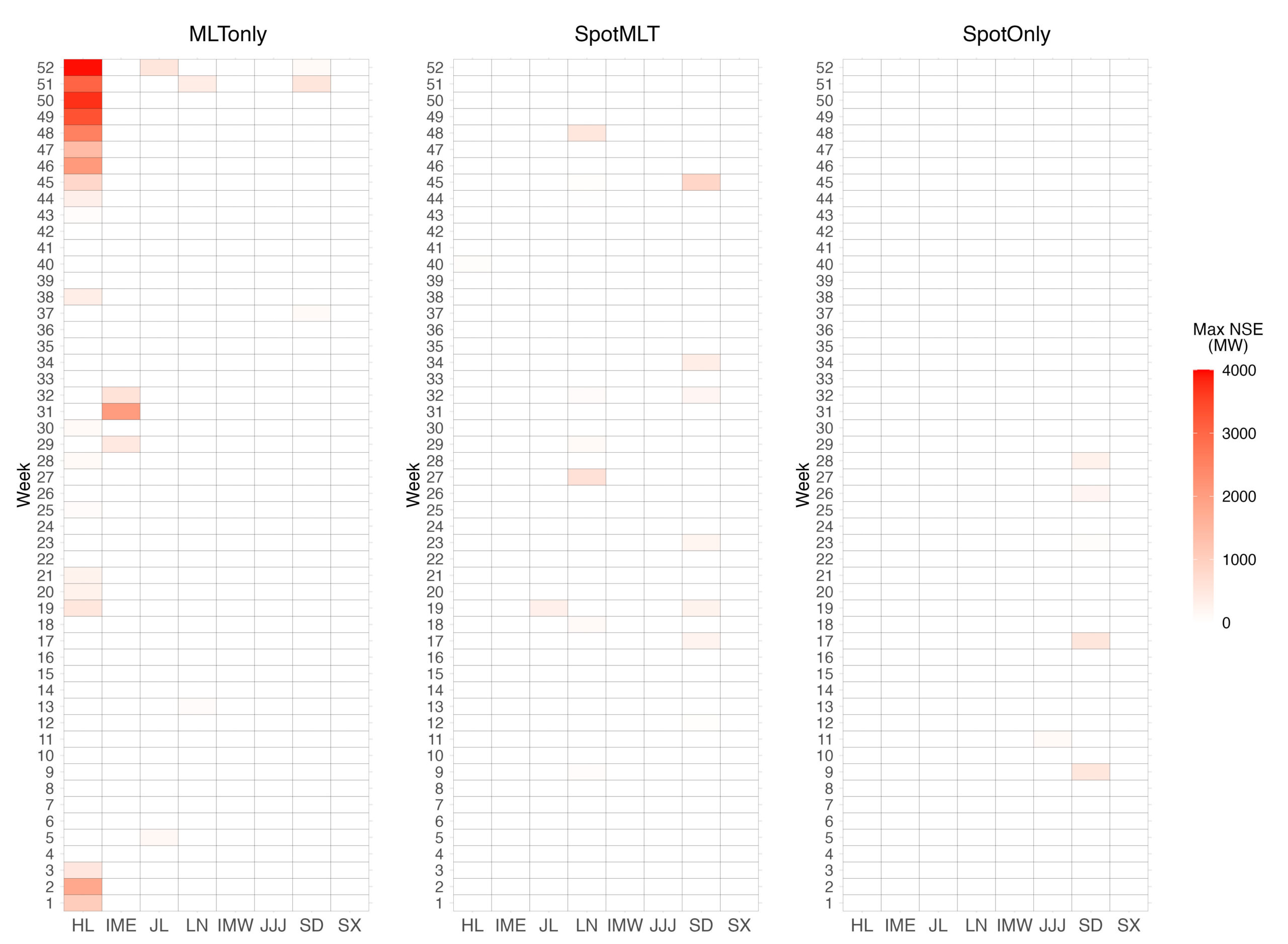

3. Forced exports caused by binding constraints from physical contracts exacerbate local power shortages.

In cases where local power conditions are stressed, forced export (i.e., inter-provincial dispatch according to MLT contracts) sometimes exacerbates nonserved energy (NSE). This effect is most prominent in the MLT Only scenario in Heilongjiang province during winter evening peak hours, when there is a significant gap between power demand and supply inclusive of export obligations. Note that the model concentrates NSE in specific locations which may differ from actual practice due to ad-hoc scheduling and renegotiation. This gap is largely erased in the other two scenarios.

Policy Implications

This paper illustrates the benefits – in terms of reduced system costs, reduced curtailment, and increased reliability – of wide geographic balancing areas with economic dispatch, guided by unified spot markets with multi-province footprints. This is an area of substantial policy development in China in recent years. In 2022, the National Development and Reform Commission (NDRC) and the National Energy Administration (NEA) issued a statement calling for a “National Unified Electricity Market System” (Document 118). However, there are several areas where this framework has yet to be elucidated and where important implementation details have yet to be decided. The following areas will be important topics for consideration:

- Document 118 does not set a clear roadmap for creating unified spot markets with multi-province footprints. Creating a roadmap for unified economic dispatch for each existing grid region, supported by a single unified spot market for each grid region would be an important step forward. The Southern Grid regional spot market is an important testing ground for this effort. Relatively simple regional spot market designs—e.g., with large price zones—could be implemented quickly, with refinements over time.

- For neighboring grid regions (such as NEG and NCG), it is important to design mechanisms to support cross-regional market integration. The key is to avoid inflexible inter-regional transfers that are scheduled far in advance. Within the State Grid region, the existing inter-provincial spot market mechanism could be enhanced for this purpose.

- MLT contracting practices (at all levels) should be transitioned away from physical energy-dominated contracts to financial contracts such as contracts for differences (CfDs), which separate dispatch from settlement. Large shares of forward contracting in this way can still provide valuable hedging opportunities for consumers and producers and reduce the risk of market power. Security of supply can be effectively enhanced through improved spot market design and/or additional mechanisms such as capacity markets or more sophisticated reliability options.

- Transmission prices that are designed in flat (i.e., not time-varying) per-kilowatt-hour terms (sometimes referred to as “postage stamp” tariffs) discourage efficient use of inter-provincial and inter-regional transmission lines. An alternative approach is to allocate the cost of inter-provincial and inter-regional transmission lines to each of the provincial grid companies on a monthly basis, calculated according to the beneficiary pays principle. Each provincial grid company could then recover these costs through retail tariffs and choose whether to implement more advanced transmission rights trading.

- Rolling regional reliability outlooks can help evaluate and monitor the performance of regional spot markets, helping to identify any needed changes to market rules and regulation as markets develop.

Supplementary Material

Methodology

Unit commitment and economic dispatch (UCED) models capture key techno-economic features of power systems operations and have been instrumental in supporting analytical work on developments of power markets around the world. In this study, we calibrate the model to 2019 in two of China’s grid regions—NEG and NCG.

Load and Generation Data

The hourly demands in NEG and NCG provincial zones are simulated based on monthly and annual consumption statistics and typical power demand curves for provincial power grids in the year of 2018 [1]. Demand for the following year is projected via an annual growth rate of 5%. Inner Mongolia is split into West and East, following grid region boundaries. Beijing, Tianjin, and Hebei are aggregated to a single “Jing Jin Ji” zone (JJJ), according to dispatch practices in China. In the event of unfulfilled demand during simulation, the model will produce non-served energy (NSE) at a considerably higher cost.

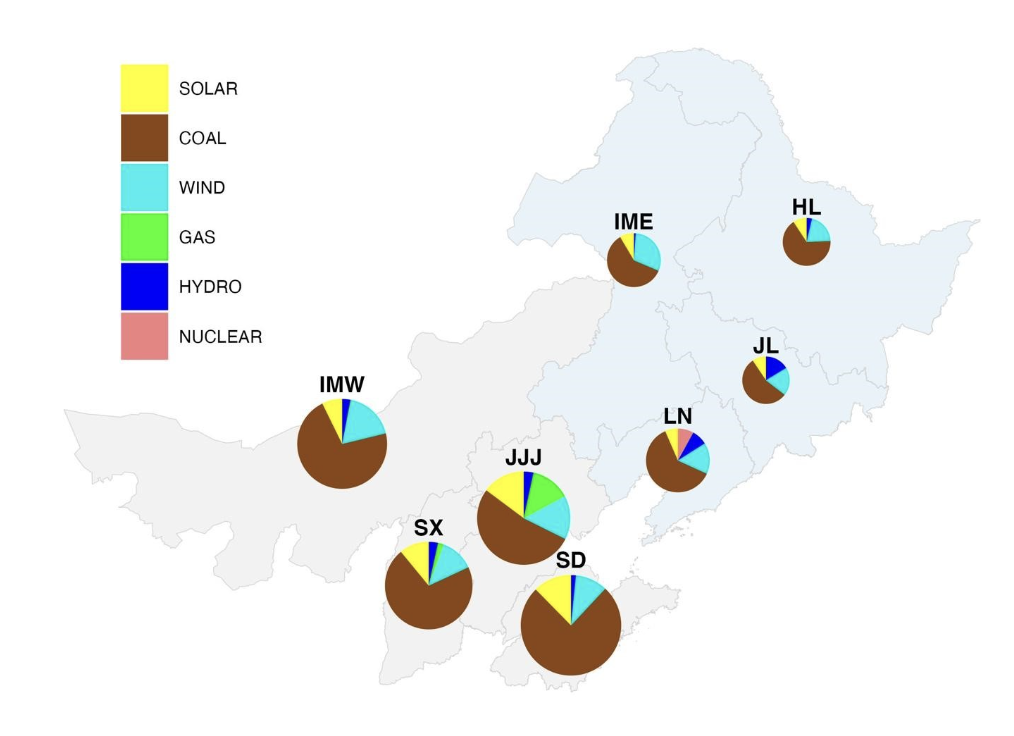

Generator information includes a unit-level classification of coal-fired generators, distinguishing between Combined Heat and Power (CHP) units and electricity-only units. Inner Mongolia West, JJJ region, and Shanxi have a small fleet of gas-fired generators. Renewable energy profiles are based on typical hourly profiles in key renewable-producing regions in each province simulated from Renewables Ninja [2]. The Northeast and North China regions showcase an abundance of wind energy resources, and collectively account for three of nine land-based large-scale wind power bases in China, namely the Songliao, Jibei, and Huanghe Jiziwan bases. Figure S1 summarizes the installed capacity in NEG and NCG.

District Heating Schedule

Northern Chinese cities operate with a centralized public heating system over winter. The exact times vary depending on local climate and can be adjusted each year in the event of early onset or extended winter. Figure S2 displays the district heating periods for NEG and NCG regions in 2019. In deep winter months, when CHP units are producing heat at maximum capacity, their corresponding maximum output for electricity will decrease to around 70% of their rated capacity [3][4][5].

Transmission Network

Transmission path capacities between each province are considered in aggregate, and transmission losses are calculated between each pair of provinces based on factors such as line lengths and voltages between each zone.

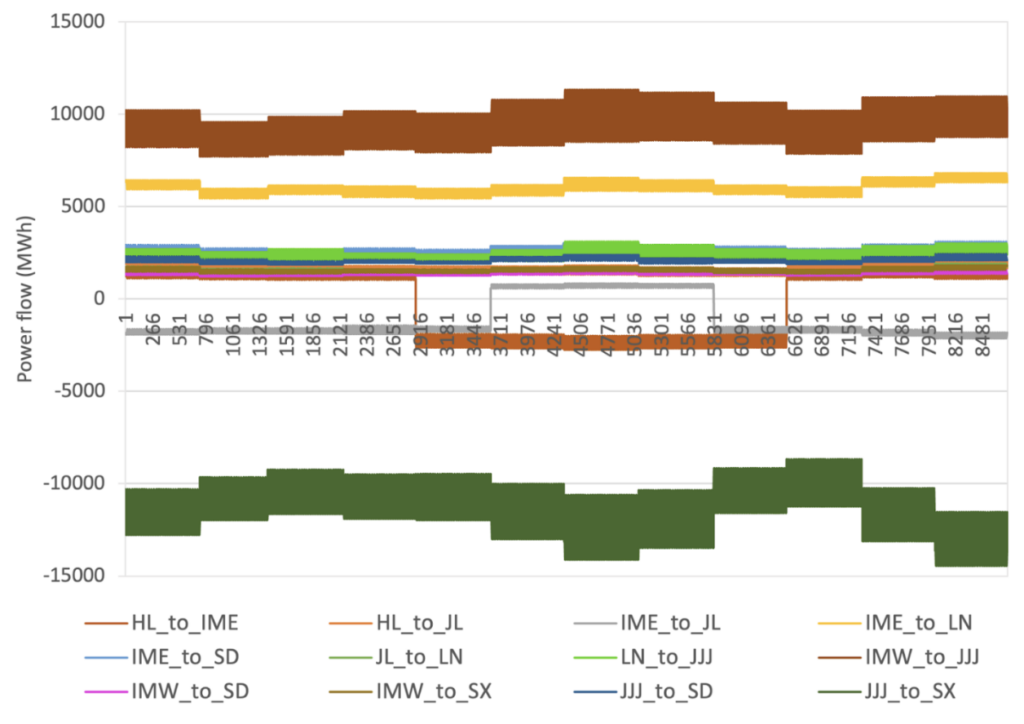

Hourly province-to-province power flows (Figure S3) are derived from annual cumulative power transmission, sourced from “2019 Compilation of Statistical Data for the Electric Power Industry”. This study focuses on the NEG and NCG—inter-regional flows to the rest of China are calculated in a similar manner and fixed for all scenarios. In practice, the amount of electricity transmitted inter-provincially does not change every hour. This study adopts a three-segment division – peak, off-peak, and valley – to categorize the 24-hour inter-provincial power transmission volume.